Amazon Grocery is Changing the Way Consumer Packaged Goods (CPG) Brands Do Business

Share:

Amazon widened its path of disruption with two highly reported updates – their newest target – the grocery market.

Recently, Amazon Fresh, Amazon’s online grocery delivery service, began allowing CPG brands to place sponsored ads in search results. Additionally, earlier this month, markets shook on rumors that Amazon will expand its physical grocery store portfolio beyond Whole Foods to include a more traditional grocery store model.

The Amazon grocery announcements have led brands to reevaluate their marketing and ad spend strategies. The upcoming changes, along with the competition and opportunities they bring, mean brands need to identify gaps in customer reach and correct them by utilizing an omnichannel approach to master the physical and digital grocery aisles.

Here is how our Adlucent experts see the updates affecting brands:

Amazon Fresh Sponsored Ads Help Smaller Brands Compete with Large CPG Brands in the Marketplace

Amazon Fresh is available to Prime members in select cities for an additional fee. For now, the Fresh sponsored ads will assist CPG companies in reaching online grocery consumers in two important markets, New York City and Los Angeles. Furthermore, Amazon Fresh sponsored ads will offer smaller brands the chance to compete with larger CPG brands, which tend to monopolize grocery.

Traditional grocery shopping remains the norm; however, in less than ten years, online grocery shopping is expected to grow from 23% to as much as 70%, according to the Food Marketing Institute and Nielsen. The rise in e-grocery shopping will necessitate a strong online presence for CPG brands. Traditional grocery retailers have increased their e-commerce capabilities in order to compete with Amazon. But for CPG brands, visibility on the Amazon platform, the leading e-commerce site where approximately half internet product searches begin, remains vital. Adlucent’s client, Homeplate Peanut Butter, has used the marketplace to make a name for themselves in their category.

“For HomePlate Peanut Butter, beyond being a revenue generator, Amazon has become a place to be seen. Amazon is where people shop and, just as importantly, it’s where people browse. Imagine being able to add your product to the shelves at WalMart or Target without the need for corporate approval. Amazon is the biggest sales channel, and you want to be in the conversation when a potential customer searches for your product category on their platform.”

– Benjamin Weiss, Director of Marketing at HomePlate Peanut Butter

Most customers who shop in person do so at well-known retailers, and there, large consumer packaged goods dominate shelf space and visibility. This brand familiarity tends to drive any secondary online purchases. Amazon Fresh, which recently released sponsored ads on its platform, may help level the playing field for smaller labels by offering the cyber shelf space they may not get at big-box grocery stores.

Jason Roussos, VP of Strategy at Adlucent, explains why these new ads are simply the cost of doing business in the constantly evolving digital world of grocery: “If a CPG company has to have the marketplace traffic and conversions to support their success, then Amazon Fresh sponsored ads should be on the menu.”

By adding sponsored ads to Amazon Fresh, all brands can promote sponsored products with an Amazon Fresh ASIN. Niche products with less prominence in organic searches now have the opportunity to contend with the leading brands by getting in front of more and more people on the marketplace.

“For HomePlate Peanut Butter, being a relatively low-cost pantry staple, while hard to directly correlate, it is our belief that garnering affordable CPM on Amazon can later convert to sales at local grocery… The low barrier to paid search advertising lets smaller brands who might be relegated to the bottom shelf at a grocery store take a few jabs at the behemoths, sometimes converting right on the spot, and other times simply making that awareness impression.”

– Benjamin Weiss, Director of Marketing at HomePlate Peanut Butter

Amazon Grocery Stores May Unhinge the Grocery Chain Industry

Amazon’s share of the $800+ billion dollar grocery market has increased, but it is no imminent threat to the big names – yet. Amazon’s growing grocery sales represent a small portion of the overall U.S. grocery market. This, however, could change rather rapidly as Amazon furthers its plans to overtake the offline grocery market to become the preferred place for groceries across the board.

Acquiring Whole Foods in 2017 was just the beginning of Amazon’s entry into the lucrative grocery store market. And, the natural foods chain acquisition has not made major waves in the industry so far. Reportedly, Amazon aims to align its expansion with a more traditional grocery store model – beyond the limits of the Whole Foods brand. The new stores, speculated to mirror mainstream supermarkets, will focus less on high-end organic foods and give Amazon the flexibility to sell more traditional consumer packaged goods at lower costs. They may open the first of these grocers in Los Angeles by the end of 2019, according to The Wall Street Journal.

This strategy is key to Amazon’s potential dominance in the grocery space and positions it to accommodate the current consumer trend of online shopping alongside curbside pickup – directly competing with today’s major grocery retailers. Amazon’s continued infiltration in this space could soon trigger more significant shifts in the industry.

Specifically, Amazon will likely innovate in-store grocery shopping as it had with physical convenience stores when introducing Amazon Go. Amazon’s “Just Walk Out” technology, which lowers overhead by eliminating cashiers, could disrupt the grocery business as they move forward with more physical retail endeavors. Grocery margins, already small, could shrink further due to competition with Amazon’s pricing structures.

As margins shrink, more encompassing approaches to increase volume become vital. To successfully maneuver these online and offline Amazon changes, CPG brands should optimize omnichannel marketing to capture customers in the many places they browse and purchase.

ShopTalk 2019 Insights on Grocery News

Amazon’s grocery expansion could have a ripple effect on the industry. At the national retail industry conference, ShopTalk, major brands recently discussed how both Amazon changes will factor into the future of grocery, and the Adlucent team explored these latest trends.

There, the topic of brand innovations, technologies, and relevance in the shifting grocery landscape pervaded conversations among business leaders and experts. Particularly, the report that Amazon would expand its grocery brand with lower-priced stores from The Wall Street Journal drove analytical discussions regarding Amazon’s encroachment into the physical grocery space. And, although the rumored plans lowered stock prices of major retailers like Walmart and Kroger, the ShopTalk executives appeared ready for the challenge – even crediting Amazon with their own brands’ improvements in the digital space.

“Amazon opening stores isn’t all bad for grocery retailers or something that should instill only fear. In the end, it keeps retailers sharp and encourages innovation.”

– Jim Donald, Albertsons, CEO via Progressive Grocer

Brands should follow the lead of major retailers in thinking ahead and incorporating new technology, like visual and voice search, into the grocery shopping experience. Visual search technology, already used by tastemakers in fashion and decor, can now accurately assist grocery shoppers to build digital grocery lists by using pictures of food products, labels or scanned barcodes.

At ShopTalk, the company pioneering this technology, Slyce, debuted new visual search technology and announced: “multiple grocery retailers are licensing its mobile SDK to power a list-building experience in their apps.” Visual search and electronic list-building will seamlessly transfer consumer data from the physical to the virtual world to enhance the omnichannel shopping experience and facilitate conversions in the changing grocery environment.

ShopTalk experts also discussed Amazon’s influence on their marketing. Currently, Amazon ranks third behind Google and Facebook in ad revenue, and as Amazon aggressively competes to boost their rank, sellers can expect more updates in ad products and potentially less visibility in organic search results.

But, considering that Amazon studies brands on its site in order to improve the performance of its own private labels, how do brands best utilize the platform while optimizing their Amazon ad spend? In the short term, brands need to focus on increasing visibility and conversions in the marketplace. Long-term, they need a way to differentiate from the leading brands, including Amazon’s imitation products.

“Amazon sales are an integral revenue stream for many CPG brands, so it’s imperative that brands take a holistic view of their business and figure out the value of a click on Amazon. Additionally, they should double down on their brand’s unique value proposition to differentiate from generic Amazon products.”

– Jason Roussos, VP of Strategy at Adlucent

Smaller brands will benefit from developing an angle that works for their target market and is specialized enough to compete against the big-box brands. Furthermore, CPG labels should keep in mind that Amazon shows its own brands among sponsored products in keyword search results and plan accordingly.

“Amazon’s private label products are ranking higher than many of the CPG brands selling on the marketplace. Amazon has been consistent in its tactic of learning from other brands to inform its private label strategy, and Fresh is no different.”

– Jason Roussos, VP of Strategy at Adlucent

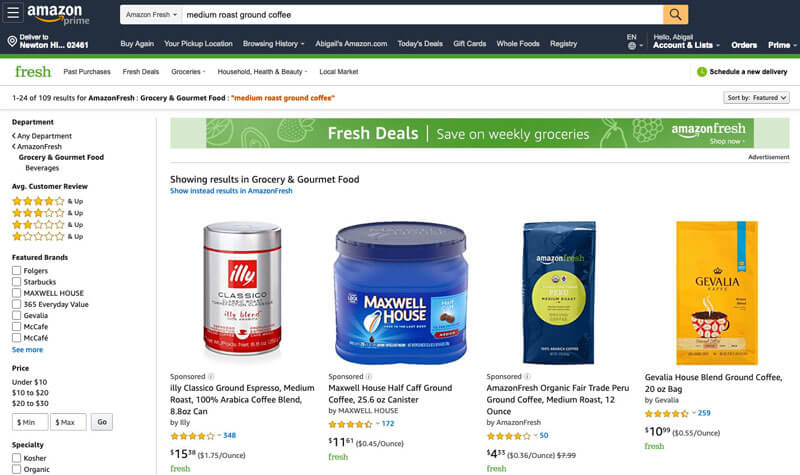

Without the right strategy, smaller brands get lost in the shuffle, especially when offered next to Amazon products selling at more enticing price points. At the same time, those with strong branding and loyal customers can continue to outperform Amazon’s private label brands and benefit from premium space on the virtual shelf. In the example shown here, most of the popular coffee brands have higher star-ratings and earn more reviews than their Amazon competitor.

In closing, it’s important that brands maintain an edge in the ever-changing grocery retail environment. Amazon and the retailers that complete with it constantly adjust business to reach customers wherever they spend. And, although the outlets and means of buying groceries may continue to change on Amazon and elsewhere, an omnichannel strategy to marketing will help ensure brand longevity.

Maureen Lomo

More Resources

Blog Post

July 25, 2024

You Heard That Right. Third-Party Cookies are Here to Stay. What Now?

Discover how Google's latest announcement on third-party cookies impacts the digital landscape. Learn the history, implications, and future strategies for advertisers in a privacy-centric web.

Blog Post

July 8, 2024

Walled Garden Attribution is Making Things Worse, Not Better

Discover the challenges of walled garden attribution in digital advertising. Learn how limited data sharing impacts campaign performance and explore independent solutions for accurate attribution amidst rising costs and economic pressures.

Blog Post

May 13, 2024

Retail Media Networks and the Call for Standardization

Dive into the challenges and opportunities of retail media networks (RMNs) as we explore the need for standardization in measurement metrics. Discover actionable insights for optimizing revenue and navigating the evolving landscape of digital marketing.