2021 Google Search Data Insights and Trends

Share:

The last two years have been anything but ordinary, but it bears repeating when looking at performance marketing data – specifically Google Search trends. We think of Google Search as the channel so driven by customer intent that it helps us understand changing consumer behavior. As we reviewed these data points from 2021, we evaluated the context of multiple years of data. Looking back to a pre-pandemic 2019 helped us understand the changes we saw in the 2020 landscape to give advertisers insight into where to go from here.

Table of Contents:

- Comparing Google Search Trends from 2021 to 2020

- Google Spend, CPC, and Clicks 2019-2020 YoY Comparison

- Earlier Retail Offers Influence Holiday Shopping

- Google Search Product Type (Text vs. PLA)

- Mobile Usage Among Consumers Continues to Grow

- Device Spending and Clicks

- Device Cost Per Click and Revenue Per Click Performance

- Google Advertising Holiday Performance

- Holiday Average Order Values

- Holiday Rolling Seven-Day AOV

- Holiday Normalized RPC by Month

- Seven-Day Rolling Average, Aligned by Thanksgiving

- Holiday RPC September to December

- Methodology For Our Data Summary

Comparing Google Search Trends from 2021 to 2020

When we look at the overall year trends for 2021 compared to 2020, we can see the vast difference in the two years’ performance. Rapid growth in clicks occurred as the pandemic ramped up in Q2 of 2020 while we were sheltering in place, and as consumers, we moved all of our retail buying behavior online. Cost per click (CPC) dropped as Amazon and brick-and-mortar advertisers came out of the auction, and other retailers faced supply chain issues.

Moving forward into Q1 of 2021, we see the impact of our trends as contrasted against a volatile pandemic-driven 2020. We started the year looking at a solid growth in clicks with modest year-over-year (YoY) increases in CPCs. As we moved forward in the year, some very tough competitors were making click growth look negative or mediocre in contrast to the boom year of 2020. But it’s important to understand what we’re comparing against and the sheer volume of consumers (and traffic/clicks) who have moved online and continue to transact online.

We ended Q4 with click growth slowing down YoY to more normal levels but still growing nearly 12%. Combined with a slightly reduced CPC growth, it drove a 40% growth in spend.

KEY TAKEAWAY: Continue to focus on maximizing the bottom of the funnel. As consumers spend more time online, it’s important to help scale the bottom of the funnel through upper-level awareness.

Google Spend, CPC, and Clicks 2019-2020 YoY Comparison

As we look more specifically at 2021’s Q3 and Q4 and compare those numbers to the “before” times of 2019, we see the strong acceleration in CPCs isn’t as significant of a challenge. As we compare spend, click, and CPC from 2021 to Q3 and Q4 in 2019, we notice CPCs are up a very reasonable 10% in Q3 and less than 2% in Q4. The above graphs show a YoY increase in CPCs; however, we must keep in mind that some changes driven by the pandemic were due to more temporary changes like less competition for CPCs with Amazon and brick-and-mortar retailers being out of the equation.

The past two years show consistent overall growth for Google Search and Shopping, concluding that consumers increasingly shop, research, and find what they’re looking for online.

KEY TAKEAWAY: Continue to maximize return on ad spend (ROAS), but don’t forget to drive consumer experiences that may also lead to sales. Such as catalog requests, email sign-ups, offline engagements, and transactions. CPCs will continue to rise, so understanding the total value of return from your marketing is key.

Earlier Retail Offers Influence Holiday Shopping

The monthly YoY trends in Q3 and Q4 of 2021 also show an interesting view. Click growth had its highest month in October, as many consumers were guided into shopping earlier as the news advised of supply chain issues. We also noticed retailers were promoting their offers earlier in the season. Retailers wanted to promote available products, and with the lingering pandemic, they still didn’t want to provide incentives for shoppers to crowd stores in the traditional Black Friday manner.

KEY TAKEAWAY: For years, we’ve seen examples in the data where consumers have been demonstrating earlier shopping behaviors around the holidays. As promotions moved earlier to Thanksgiving and prior, consumers followed suit. However, in 2021, the perception of the offers was different. Data has indicated that the deals were available longer and didn’t cut as deep for retailers (i.e., retailers didn’t have to extend offers as they may have done in the past.) As a result, retailers may have learned they don’t have to offer the deepest discount to capture consumer dollars. It will be interesting to see if this sticks — more on holiday shopping in a later section.

Google Search Product Type (Text vs. PLA)

Google Shopping and Product Listing ads (PLAs) continue to take up a large share of Google’s search engine results page (SERP) results, with product ads accounting for nearly 90% of both clicks and costs for the advertisers we’re managing. Those product ads have continued to grow in clicks as the product type grew over 19% YoY for the average advertiser. On the other hand, text ads saw their third straight quarter of YoY traffic decline as competition with brick-and-mortar advertisers for Local Inventory Ads (LIAs) and Amazon continued their resurgence in the product type.

With minimal CPC growth and declines for product ads in 2020, we saw CPC increases for the popular product types in 2021. YoY CPC growth was over 20% for each of the past three quarters. In Q4 alone, arguably the most competitive quarter for product ads as retailers strive to capture those all-important holiday sales, we saw CPCs grow nearly 27% YoY.

KEY TAKEAWAY: Be sure to leverage all product types to capture the full value of the SERP. For brick-and-mortar retailers, leveraging Local Inventory Ads (LIAs) grants you a space to play where you don’t have competition from Amazon and other online pure-plays. This allows an efficient way to help drive your brand’s in-store (and online) sales.

Mobile Usage Among Consumers Continues to Grow

Looking at the three typical device forms – computer, mobile, and tablet – it’s clear only tablet has continued to consistently decline (although at varying rates) in spend for our average advertiser. With mobile device form factors generally continuing their trend of growing more extensive over time, consumers are spending more time replacing tablet engagement with mobile engagement as a second screen. Perhaps most notably, as society has been returning to a more mobile lifestyle, it makes sense we’d see mobile growth higher than computers over the past four quarters. We expect mobile to continue its relatively strong growth as we see a resurgence of in-person activities throughout the following year.

Much like our spend chart above, clicks on tablet devices for our average advertiser continue to decline as consumers opt for mobile devices. The difference between clicks and spend highlights the YoY growth in CPCs across the formats over the past three quarters.

Device Spending and Clicks

While there was a bit of volatility in click and spend share in 2020, due to fewer people on mobile, we saw a more normalized pattern moving into 2021. More consumers were using mobile to research and identify what they needed and where they needed to go.

One trend that has returned is the consistent balance of the share of spend between mobile and desktop. However, there is a definite imbalance when it comes to clicks.

Looking at our Q4 data, we see spend share for both mobile and desktop devices was even at just over 49% of our total Google spend going to each device type, with less than 2% going to tablets. However, when we look at the click share, we see that nearly 3/4 of the clicks we saw on Google Search and Shopping came from mobile devices, while just under 24% of clicks were coming from desktop devices. This demonstrates the pricing disparity that we’ll dive more into in our next data point. Mobile CPCs are cheaper, given a multitude of factors.

KEY TAKEAWAY: It’s essential to be where consumers are engaging. If you had pulled back any mobile spend or targeting on Google or any other platforms during the pandemic, you must re-evaluate that approach to capture shoppers on the go.

Device Cost Per Click and Revenue Per Click Performance

As we look at device-level stats in more detail, we can see the CPCs for the average advertiser on tablets are only 42% of the CPCs for the average advertiser on desktops. Similarly, average mobile CPCs are 67% lower than the average desktop CPCs.

One big reason for the lower CPCs is likely because there are fewer competitors in the local space, namely Amazon, so the overall auction density is less when it comes to local ad units, which provides much more efficiency for advertisers with a local presence.

Another distinction we still see when looking by device type is a clear difference in overall revenue per click (RPC). RPC is an excellent measure of buying intent and can show how well a category, channel, or device type is at closing a sale. Looking at these figures for Q4, we see the average advertiser RPC on mobile devices is less than 24% of the average advertiser RPC on desktop. Consumers are still more likely to purchase on desktop than portable devices. More of the mobile clicks might not be specifically transaction-focused but serve as a digital connection to the physical world. We work with our advertisers to ensure we’re including those potentially untracked or unrecognized revenue values in their campaigns.

Google Advertising Holiday Performance

It’s challenging to look at consumer trends over the past two years because there hasn’t been consistency across the period. Consumers avoided shopping in person during the pandemic, but that has started to change with more shoppers making their way back to their favorite stores. It becomes evident in the following few data sets what has happened to ecommerce since the pandemic.

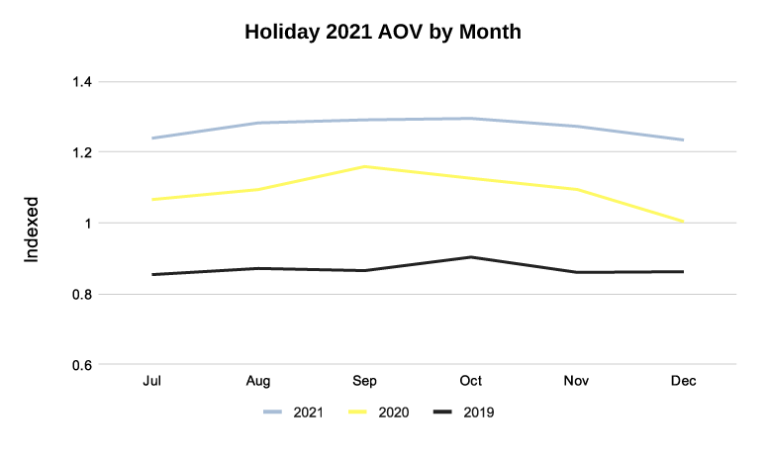

Holiday Average Order Values

It’s not uncommon to see Average Order Value (AOV) drop off during the peak holiday shopping season in December. This is partially due to discounts and consumers spending less on others than themselves during these critical shopping times. In the below chart, we’re looking at the AOV for the second half of 2021 across our average retailer by month.

Note: For 2019, Thanksgiving occurred the latest of the three years, so more of the initial AOV spike would have come in December.

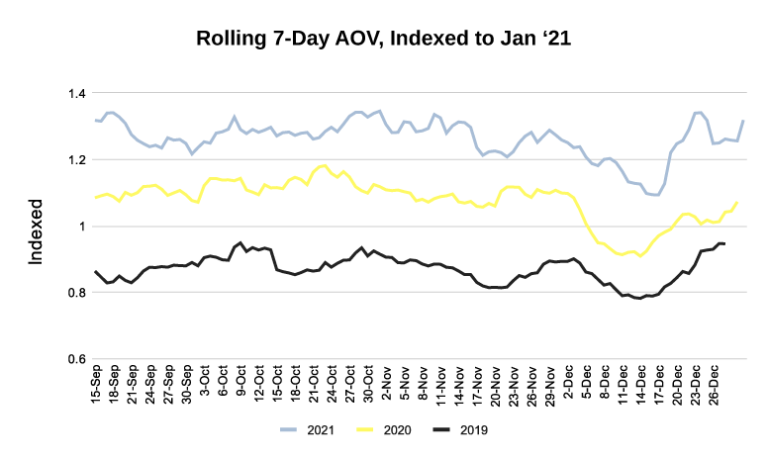

Holiday Rolling Seven-Day AOV

For all three years, we’re looking at the seven-day rolling average of AOVs across advertisers from mid-September to December, indexed against the January 2021 average AOV. These lines are positioned to Thanksgiving to account for holiday variances.

Note: The X-axis consists of 2021 dates.

We can make a couple of observations from these trends. First, AOVs traditionally rise at the beginning of the shopping season and then drop significantly for key shopping periods after the Cyber 5, before rising again going into the Christmas Holiday itself. This may be due to a mix of bigger deals early when individuals are shopping for multiple people (and themselves) followed by a period of buying for others, opportunistically grabbing deals until the time is running out.

Interestingly in 2021, we don’t see as much of a drop-off in AOV right after the Cyber 5 as we did in 2020 or 2019. This could partially be due to shopping pulled earlier because of supply chain messaging and fewer deep discounts because retailers didn’t need to drop prices as much. The lift towards Christmas was also more extreme this year. We hypothesized that there were last-minute gift card and “second choice” purchases when desired out-of-stock items didn’t return in time for holiday gift-giving.

Holiday Normalized RPC by Month

Revenue per click (RPC) is a good metric to look at as a way to understand the conversion rate changes that directly relate to changes in consumer behavior – rather than those having an impact from CPCs or the changing media landscape.

As we look at the last few months of the past three years, we see the revenues per click for the average advertiser (normalized against January 2021) have significantly grown since 2019 and throughout the year. We also see the most prominent growth rate in August, September, and December of 2021.

An acceleration in RPC in August and September of 2021 can be partially attributed to a full return to school, concerns about global supply chains, and potential product availably later in the year. We also saw an increase in December shopping over December of 2020, as those gift-givers who were holding out, decided they would buy when the deepest discounts never materialized.

Seven-Day Rolling Average, Aligned by Thanksgiving

With this chart, we’re looking at the rolling seven-day average RPC normalized against January 2021 for our average advertiser. By looking at the rolling average, we can soften some of the daily extremes. We’ve positioned the data to Thanksgiving day so we can see what happens forward and backward from Thanksgiving each year.

As seen above, the average rolling patterns line up each year. In 2021, we do see some specific timeframes where consumers were likely buying in advance of the Cyber Weekend (early November) or waiting until the last minute (late December) to make a purchase.

Holiday RPC September to December

As we zoom in on the holiday period more, looking at the difference in the rolling seven-day RPC average, we can see the most increases in conversions this holiday period came from mid-October and late in December. In contrast, we had nominal gains in conversions right around the Cyber 5 holiday. We believe a portion of these gains can be attributed to the constant press we saw in 2021 about encouraging Americans to buy early to avoid potential supply issues. The significant end-of-year increase is also potentially related, as shoppers either didn’t find a better deal, had to settle for what was on the shelf, or ended up opting for gift cards from their favorite retailer.

Methodology For Our Data Summary

Adlucent is a leading provider of Shopping ads management, managing more Shopping spend in 2021 than any other agency. To ensure we’re looking at an accurate trend of the data, we’re only looking at the same client data for advertisers who have been with us for over nine quarters and maintained a minimum amount of ad spend. As you would expect with a significant Shopping spend, this data set represents almost entirely retail clients.

Adlucent is the performance marketing agency built for no-limit breakthroughs. Contact us for help with your paid search, social, display, and retail media campaigns.

Ryan Gibson

Ryan is VP of Strategy at Adlucent. He has over 15 years experience working with digital and multi-channel marketers to drive better results from their programs. His perspectives of online marketing are based on analyzing data-driven insights from an array of advertisers - from enterprise to start ups - as they capitalized on customer-centric, full-funnel programs across search, social, shopping and digital media.

More Resources

Blog Post

October 9, 2024

10 Holiday Stats Every Retail Marketer Should Know

Discover 10 essential holiday shopping stats for retail marketers in 2024. Learn how to boost your campaigns with insights on omnichannel strategies, video ads, BNPL, and more."

Blog Post

September 5, 2024

Adlucent Awarded Google Marketing Platform Certified Partner Status, Strengthening Client Solutions

Adlucent, the performance media, analytics, and data agency that recently joined forces with BarkleyOKRP, is officially a Google Marketing Platform (GMP) Certified Partner for Display & Video 360 (DV360), Campaign Manager 360 (CM360), and Search Ads 360 (SA360).

Blog Post

August 28, 2024

The FTC’s Crackdown on Surveillance Pricing: What You Need to Know

Explore the controversial rise of surveillance pricing and the FTC's investigation into its implications for fairness and consumer trust. Understand how personalized pricing impacts retail competition.